When you first start out in business, overhead probably isn’t at the top of your list of concerns. But as you grow, add tools and equipment, think about hiring an office admin (that’s an overhead position), and watch the bills roll in, you just might start asking yourself: how much overhead is too much for a landscaping business?

Real quickly, let’s define overhead expenses.

Overhead expenses are the expenses you have to keep the lights on and doors open. They are not expenses related to doing a job such as field labor or job materials. They are indirect expenses that you will have whether you’re working or not, such as insurance, electricity, shop rent, office admin, marketing, vehicles, etc.

Another way to think of them is: that you can’t charge a customer for these expenses. You’ll need to cover these expenses in your markups, aka “overhead recovery markup” when pricing a job.

So, how much overhead is too much?

It’s certainly possible to incur too many overhead expenses for the size of the business you are in.

It’s also possible to choke off your company’s efficiency and productivity by being too stringent on adding overhead expenses.

Too much overhead

For instance, an example of too much overhead is let’s say you’re just starting out, you have 2-3 team members “doing the billable work”, in the $300k-$600k annual revenue range.

If you bought/rented a beautiful large shop space, and office space, hired an office admin, bought new trucks for everyone… you simply wouldn’t have enough revenue and production to cover all these overhead expenses and still make a profit. If you did the math and made your overhead recovery markup high enough to cover the overhead and make a profit, it’s a likely assumption that you’d price yourself out of the market, because just the overhead recovery portion of your job price would have to be over 30% of the total price.

Too little overhead

On the other hand, an example of not enough overhead expenses would be to starve your company of infrastructure, aka overhead expenses. Let’s say you’re trying to save a buck, so you refuse to hire an office admin. You’ll just do all the work yourself.

But in doing all the work yourself, you rob from your available time to complete jobs, get bids out to clients in a timely manner, etc. Which means you cut back on your production capacity.

If you’d just hire that office admin, you would free up more of your time to focus on high-value tasks and produce more revenue. If you’d just buy that equipment, you could get more jobs done in a season, increasing your production capacity.

How to think about overhead

Back to the original example I opened this article with: bills keep rolling on in, and you’re thinking of cutting overhead costs.

Here’s the question:

Should you cut overhead expenses to create some margin?

Or should you focus on producing more revenue, and more production capacity, with the overhead infrastructure you have?

Sometimes the answer involves both solutions.

But before you just go nuts cutting costs, ask yourself if you are just going to choke off and starve your company’s ability to produce. Or efficiency will just end up suffering.

I would argue that rather than cutting the office admin and sucking yourself back into all those time-sucking tasks, focus on how you can produce more revenue to better cover the cost of the admin.

Rather than cutting that software and going back to spreadsheets, ask yourself how this will impact your ability to turn around a quote to a customer quickly to more effectively close jobs.

Rather than cutting the equipment that allows you to save time and be more efficient, consider for a moment how your capacity will be impacted by making that cut.

That said, there may be times you simply have too much overhead, and the answer is to cut costs. Because even if you boost revenue/production capacity, that overhead expense may still not make sense.

For instance, are you paying too much for a shop/office space you really don’t need for the size of your operation?

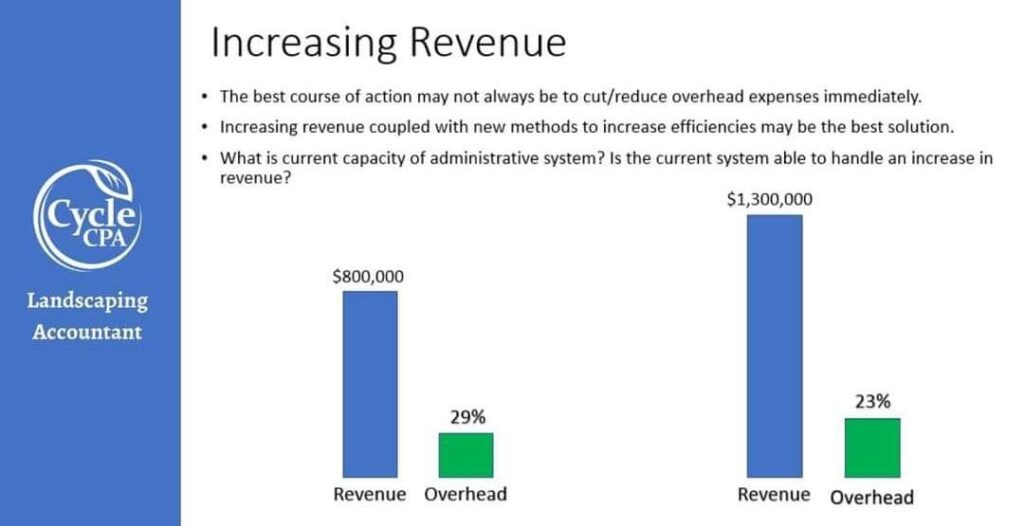

Carla Policastro from Cycle CPA is who inspired me to write this article. She did a webinar and post on Facebook with a graphic that I think portrays this topic very well.

The “balanced” overhead formula

The way I typically look at overhead expenses for a landscape business that does installations is: strive to keep overhead under 30% of your total revenue.

Meaning if you have a $1m in revenue, keep overhead under $300k.

If you’re far lower than that 30%, you’re probably not investing in your infrastructure and efficiency enough, and it’s costing you more in opportunity cost than the expenses than you’re saving.

If you’re much higher than that, I’d be asking myself if my company infrastructure is too heavy for the size of the company I am, or if I should be able to squeeze more production and efficiency out of the infrastructure I have.

There are a ton of ways to split hairs on this topic and many nuances. So don’t get too hung up on the particulars in my examples.

But if you’re wondering where you stack up in this “30% rule”, head over to our free budgeting tool and plug in all your revenue, labor, and overhead expenses and see where you stack up!

Hit me up with any questions!

Cheers,

Weston Zimmerman