Every once in a while I run into someone that uses QuickBooks to run their business and wonders out loud why they’d need another app (like SynkedUP) to run their business.

On the flip side, I also run into folks once in a while that want an app like SynkedUP but thinks they don’t need QuickBooks. I’m not going to dig into that in this article, but just suffice to say, “YOU NEED QUICKBOOKS!” 😂 Without it, you can’t see critical reports that you need to analyze your business’s health. Not to mention things like preparing for year-end taxes. And filing state sales tax is easy to mess up without a system like QuickBooks.

The truth is you need both. QuickBooks for accounting, reports, and tax prep. And then operational software to run your business day-to-day, where your team can see job info, you can schedule jobs, communicate with customers, and track jobs. All of this makes your day-to-day life much easier and more organized, saving you precious time.

What QuickBooks is not built for, and won’t help you with:

- Building a company budget to determine your pricing

- Estimating jobs

- Scheduling& Operations

- Showing detailed estimated vs actual analytics on your jobs

- Showing you job info in the mobile app

Building a company budget to determine your pricing

Before I confuse you, yes you can build a budget in QuickBooks, but a budget in QuickBooks is used to track your company’s actual spending against what you had projected. When building a budget in SynkedUP, it’s to determine what your pricing should be.

How much should your labor rate per hour be? How much should you mark up your materials? How much overhead do you have, and how much do you need to mark that up to get to breakeven and cover the costs of operating your business?

This is the budgeting that SynkedUP does. We use the same word “budget”. But two expressly different purposes and tools. In SynkedUP, budgeting is a slick tool where you plug your costs in, and it spits your pricing back out. And this isn’t a one-and-done action. If you buy a new truck, it’ll change your overhead, which needs to change your pricing and rates. If anything changes with your company’s expenses, your SynkedUP budget needs to be updated before you send out that next quote to a customer. Otherwise, your pricing on that quote will be wrong, and you could lose money. The tricky part is, it takes a long time before it’s evident that you were losing money. I have some friends that got in trouble for not keeping their budgets updated. I recommend checking your SynkedUP budget against your actual expenses once a month, or at least once a quarter.

Estimating jobs

This one is pretty simple to explain. Yes, you can build an “estimate” in QuickBooks and send it off to the customer. But when you’re building out that estimate in QuickBooks, what you’ll see is a blank field to plug in a description on that line item and a blank field to plug in your price.

But QuickBooks won’t tell you what that price should be.

SynkedUP allows you to plug in all your materials, labor, and measurements, and it tells you exactly what that price needs to be to cover your costs, and overhead, and generate that net profit you’re shooting for. In short, SynkedUP does the math for you. QuickBooks doesn’t and therefore is not going to tell you if you screwed up your math. Opening you to risk of losing money.

Scheduling & Operations

QuickBooks help you run your business finances, report, get paid, do your payroll, etc. But it won’t help you with the actual production and planning of the job. SynkedUP allows you to not only budget, estimate, and get paid, but also schedule the jobs, and get digital job folders with job details, notes, photos, work areas, and more in the mobile app. It blends the financial and the operational all into one seamless flow.

The end result? Your phone rings a lot less from your team on questions about jobs, where to go, what materials they need to get, etc.

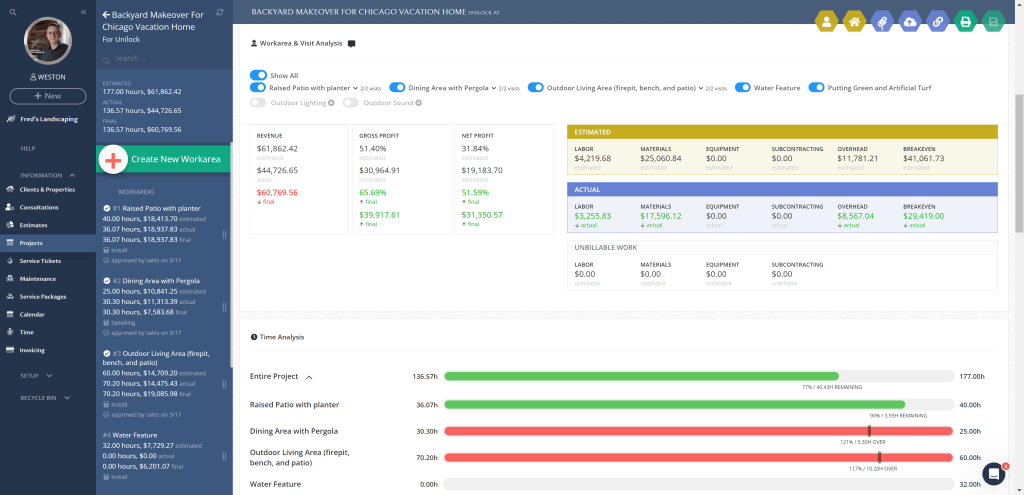

Estimated vs actual analytics on your jobs

QuickBooks does have a Projects feature, where you can track basic hours and expenses inside a single job. But it isn’t very detailed, which also means it’s hard to learn from it, and isn’t actionable. In SynkedUP, you can track detailed hours, materials, expenses, subcontractors, receipts, and more all inside a single job, live, in real-time. Which allows you to know exactly what part of the job is causing overruns or issues.

This gives you the info and data to not only not make the same mistake again on the next quote but also gives you solid data on the production ability of your crew. Just how many sq ft of patio can you install per man-hour? And so on.

It’ll also show you exactly how much true net profit you actually made on that job. QuickBooks can’t do that. It’ll only show you gross profit, and you still need to cover all your overhead expenses out of that gross profit. It can “look” as though you made an excellent gross profit, but I’ve seen countless times how those overhead expenses are higher than you thought, and it wiped out the gross profit and you were left with pennies of net profit. Working for free essentially.

What QuickBooks is built for, and does well at:

- Categorizing your banking transactions and tracking assets and liabilities to produce standard financial reports like a Profit & Loss and Balance Sheet

- Invoicing

- Time tracking & payroll

- Managing tax liability

Reporting

I won’t sugarcoat it. Without a Profit & Loss, Balance Sheet, and Cashflow statement, you are blind. Before you roll your eyes and move on, hear me out. This is coming from a guy that didn’t know how to read these reports not that crazy long ago. Find a mentor, uncle, dad, or accountant, or Youtube it, and learn how to at least understand the concept of these 3 reports.

Looking at your bank account balance to judge how well you are doing or not doing is literally playing Russian roulette with your business’s survival. I’m not overstating that.

QuickBooks makes it super easy to manage and produce these reports by connecting to your bank account. You can set up automated rules so it does 90% of the categorizing transactions for you.

Invoicing

QuickBooks is great at invoicing. They make it super easy to pop a link or email off to the customer, they can click on the invoice and pay electronically. With this convenience, you end up getting your money much faster than if you depend on cash/check. My favorite feature is the ability to see whether they’ve opened it, and how many times, and exactly when they’ve opened it. When a late-paying customer tries to spin a story of “Sorry I never got it, must have gone to spam.” You can see and reply with “Well, I see you’ve opened it 6 times in the last month. Once on Tuesday, again on Saturday morning….” 😜 Suffice it to say, you get paid.

Time tracking & payroll

QuickBooks has a pretty nice time tracking app that flows the hours your team has logged straight over into payroll. Makes it super easy and convenient. Make that admin stuff someone else’s problem. Not your own. That said, SynkedUP’s time tracking app goes a step further and allows you to track your time in each work area in your job. Then it still flows those hours right over into QuickBooks and their payroll.

It’s one thing to know you went over or under hours on a job. It’s another thing to know exactly which part of the job was the problem. When you know that, you can actually react and do something about it.

Managing tax liability

When you have clean books, tax liability is a breeze. QuickBooks will tell you exactly what you owe in state sales tax, and you can file those in a few clicks. And tax planning for your federal taxes is much easier. Should you invest in your business at the end of the year to reduce tax liability or not? With clean books, your accountant can actually help you make good decisions. Without clean books, there’s no visibility, meaning they won’t be able to do much for you, and the focus turns to doing whatever needs done to avoid triggering an audit.

I get that many of us in this industry start by doing side jobs, we keep track of everything on paper or a spreadsheet or use a free invoicing app. By the time you are hitting $100k in gross sales, to me, QuickBooks is non-negotiable. Tracking that on paper isn’t feasible anymore.

The most common scenario where I’ve seen business owners question the need for QuickBooks is when they have one of those invoicing apps (Jobber, Invoice2Go, etc) that also connect to your bank account and process your payments for you. This doesn’t replace the need for Quickbooks.

Final tidbit

Final tidbit before I risk losing your attention on this dead horse I’m beating. You need to own your OWN QuickBooks account. And then give access to your accountant. Not the other way around. It’s frightening how many times I talk to owners who never log in to their QuickBooks, and just say “My accountant does all that for me, they have my account, I don’t even have a login.”

What happens when your accountant vanishes, goes sour, or starts neglecting your books and you need to find another option?

What are you thinking by now, after reading this epistle? 😅 Drop me a comment!

SynkedUP is a QuickBooks Affiliate, which lets us give you access to an exclusive discount on your QuickBooks subscription! 🙌🎉