“Know your Numbers” is a cliche term that gets thrown around a lot in the landscape industry. You see it dropped in Facebook threads, events, seminars, courses, etc.

A lot of newer contractors will go to a landscape or hardscape Facebook group, post a photo of a job they’re bidding, and ask what they should charge. The response they usually get (well, there’s a lot of responses, with varying levels of rudeness 😅) but at least one comment will usually chime in and say: “you gotta know your numbers!”

In fact, I’ve commented that personally on posts like that myself many times! ha ha

And it is true.

To know what you need to charge, you DO need to know your numbers. There is no easy one-size-fits-all answer to that question.

It might be frustrating for you though. Everyone’s throwing around the “Know Your Numbers” phrase as if they automatically expect you to know exactly what that means.

Well, I’ll explain what it means.

I’m not going to go on long-winded, showing you HOW to know your numbers. I’m just going to explain WHAT it means to know your numbers. If you want to learn HOW to know your numbers, I created a free course on hardscaper.com that goes in-depth, teaching you all the nuts and bolts of HOW to know your numbers.

So, there are two main components to knowing your numbers.

- Budgeting and estimating

- Job Costing to compare estimated vs actual profits, man-hours, expenses, etc.

Budgeting and Estimating

The budgeting and estimating part of knowing your numbers is what is going to show you what you need to charge. To start, you need to build a budget, which means tally up and project your:

- Sales goal

- Material & product costs

- Field Labor costs

- Equipment costs

- Subcontractor costs

- Overhead costs

for the year. You can do this in our free budgeting tool. Once you’ve done this, that budgeting tool does the math to figure out how much you need to mark up your direct costs like materials and field labor, to also cover all your indirect costs, aka overhead.

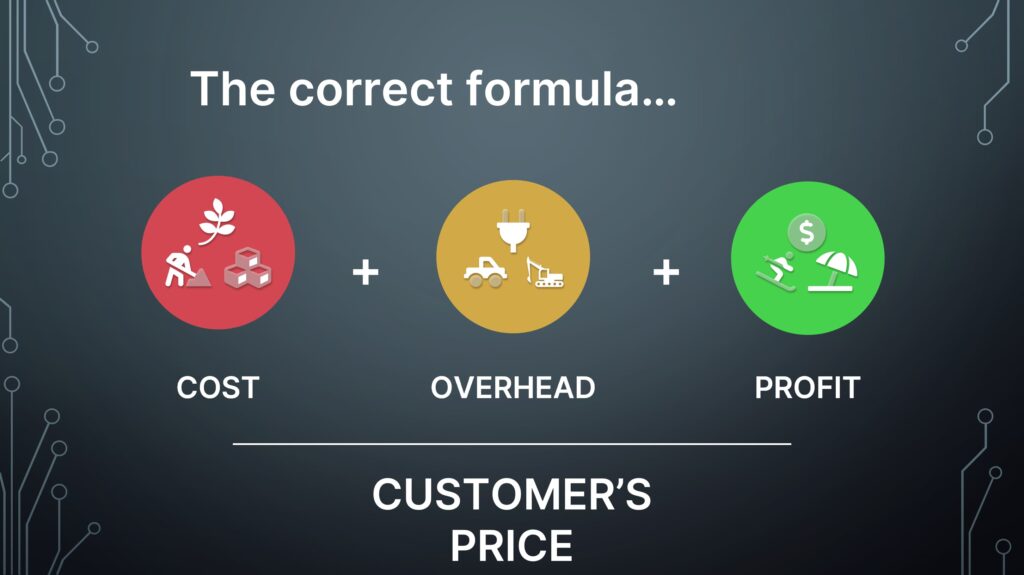

The whole point of building a budget is to find out what you need to mark up your COSTS to cover your OVERHEAD, so you can know what your BREAKEVEN is. Breakeven is your costs + your overhead recovery amount added together. Once you have your breakeven, you can then add your desired profit margin, and bingo, you have your customer’s price.

Here’s what you do NOT want to do:

And, here’s what you DO want to do:

So again, the point of building the budget is to determine how much you need to mark up your costs (pavers, stone, field labor, subs, etc) to also cover your overhead and cost of doing business (insurance, fuel, shop, trucks, owner’s pay, etc.) Just that one point alone of recovering overhead has saved many struggling businesses in North America. And the reason there is no one-size-fits-all answer is each business has different overhead costs. Meaning each business is going to have to mark up their costs by a different percentage to accurately recover their overhead, and not charge too much or too little, but just right, to cover all your costs associated with the job, + all the overhead costs you have while producing that job, + making a profit. If you do not accurately recover overhead, what often happens is what you thought was your profit, gets sucked right back up by overhead costs you weren’t accounting for when you came up with the price of the job.

Job Costing

Ok, so we covered the budgeting and estimating portion of knowing your numbers. But we aren’t done yet. You could do all the budgeting and estimating work perfectly, correctly mark up all your costs and do all the math on your estimate correctly, … and still, get it wrong. There’s the last component of knowing your numbers: job costing. What I mean by job costing is taking each job you do, and once it’s completed, review it to learn:

- knowing where you went right

- knowing where you went wrong

Meaning comparing estimated vs actual material and subcontractor expenses, man-hours, profits, etc. When you compare the estimated vs actual, and you actually SEE where you went wrong and right, you can avoid making the same estimating mistakes over and over again. What do you mean make estimating mistakes? You thought I just said we solved that problem in budgeting and estimating, no? Well, here’s the deal. You can do all the math and markup percentages perfectly, but if you don’t get the quantities correct, you can still get it way wrong. By quantities, I mean quantity of man hours, stone, pavers, plants, etc. If you estimated that a job should take 80 man hours, but it actually took 110, all the profit you thought you were going to make gets blown away and vanishes because of the additional labor costs, AND the opportunity costs of robbing those 30 man hours you ran over on, from being able to be working on another job, producing more revenue. So you see how getting the quantity wrong can blow away your profits and cause you to lose money, in the exact same way as not doing the math and markup percentages correctly on the bid. So KNOWING YOUR NUMBERS means doing the math correctly (budgeting) AND comparing estimated vs actual values on the job to see where you went wrong or right (job costing).https://youtu.be/m_xy2tZsLw8

Tracking

To pull off the job costing, you’ll need to track all your actual man-hours and expenses so that you actually have the data available to compare at the end of the job. You can do this manually in a spreadsheet, or if that sounds daunting to you, you can also use our SynkedUP app to track this very easily, and automatically produce the job costing. And bonus – your crew can see exactly how they are tracking on the job they are on, which does wonders for motivating them to think like owners, and connecting the cause and effect, or the “why” the job ran over or under on hours and expenses.

Conclusion

So, in conclusion, knowing your numbers is a two-part recipe: getting your math and markup percentages dialed in to accurately recover your overhead, and comparing estimated vs actual values so that you can make sure you’re not screwing up the bid by underquoting hours or expenses.

If you only do the budgeting and estimating part, that’s a huge step in the right direction, but you still leave yourself open to the risk of losing money by not bidding quantities correctly.

Ping me a reply in the comments if you have any questions on any of this, or need a hand. We have a full-time staff that helps figure all this out for you, dramatically expediting the learning curve, when you sign up for SynkedUP.

If you find yourself struggling in this area, you need to dial in the “know your numbers” element of your business to truly unlock profitability and growth for your business.

Cheers! and have a great week!

Weston

Weston Zimmerman

CEO and co-founder