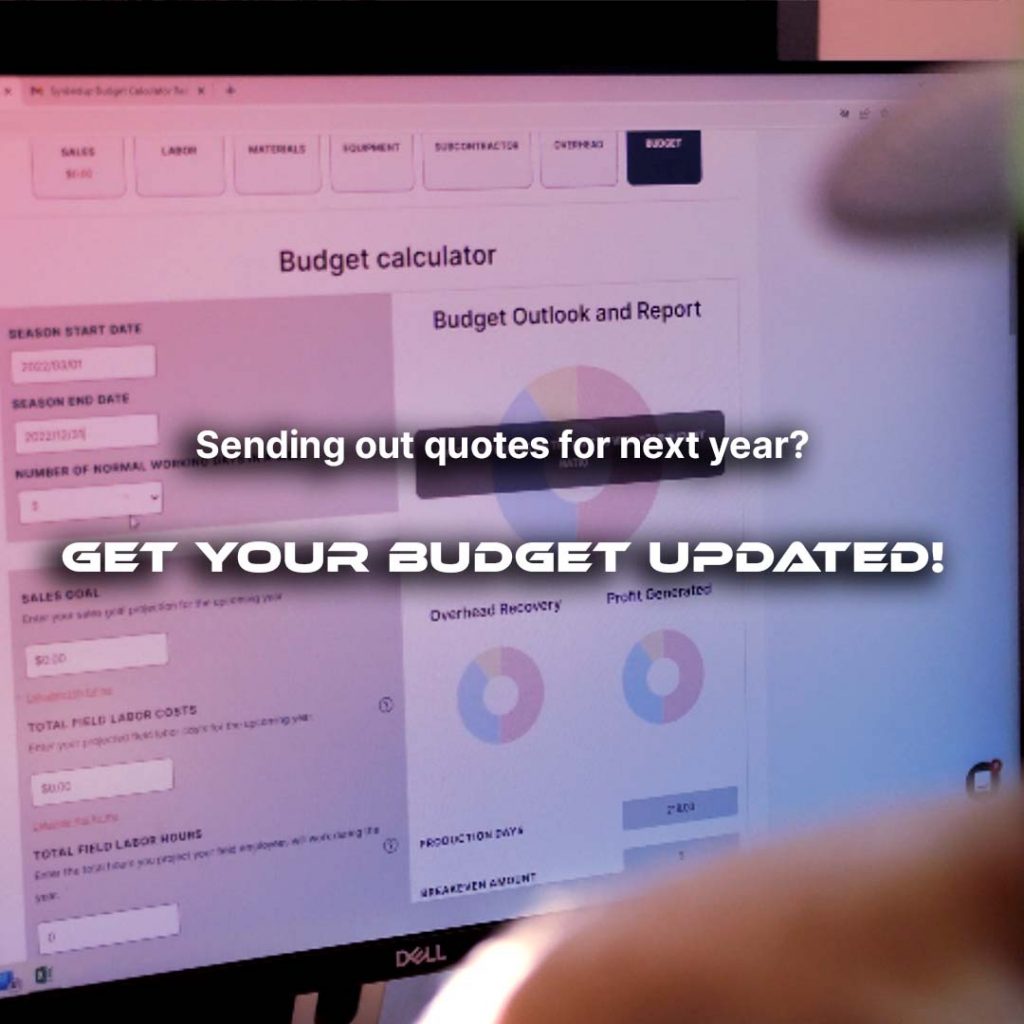

Sending Out Quotes for Next Year? Get Your Budget Updated!

All booked up for the year and sending out quotes for jobs that will be on next year’s schedule? Time to get that budget updated!

For perspective (if you’ve never built a budget), a budget is the foundation of knowing your numbers, and it sets your markup percentages on your costs for you. If you’ve never built a budget, check out our free budgeting tool here, as well as a webinar training I just did today for our SynkedUP Crew on updating budgets. As I’m going through the points below, I’m referencing some fields and stuff in that budgeting tool.

Back to why you should be updating your budget to prep for 2023, even though it’s only October. If you’re sending out quotes for next year’s schedule, you want to make sure those prices are accurate, and not underpriced. Meaning you want to be using your 2023 budget for those quotes, not your 2022 budget.

So, anyway, hopefully, I’ve convinced you to make time to sit down for a bit to review and update your budget. I’m going to spend the rest of the article going over a couple of things for you to consider as you go to update it.

Budget for the business you want to be, not the business you were yesterday

This is a big one. A lot of times it’s easy to have a scarcity mindset, and think “I can’t afford that engcon” or “I can’t afford that office admin” that you need so badly. Worse than the engcon tiltrotator probably 😜

I’ve got a solution for you.

Put the cost of that item you’d like to have for your business in your budget. Then… if you can still sell jobs at the prices that budget produces for you, there’s your permission to go buy that toy or hire that next person! You’ve sold the job, at a markup that is producing the revenue to cover the cost of that toy. The funds are coming in, go buy it! 😎

Unbillable Hours

Remember unbillable hours! Unbillable hours are for things like shop work, equipment maintenance, trainings and meetings, warranty callbacks, etc. Those payroll hours cost you money, but you can’t bill anyone for them. It’s an overhead expense. If you’re using the free budgeting tool I linked above, it’s easy, we have a slot for you to plug those unbillable hours into.

The first question though is, “how do I find out how many unbillable hours I should budget for?” That’s the million-dollar question. Hopefully, you’ve been tracking your timesheet hours in an app like SynkedUP, which can show you the answer and make it easy.

But if you haven’t, there are two things for you: 1. Starting tracking! and 2. a safe average is 5-10% of your total payroll hours are unbillable.

Equipment Expenses

Take time to go over all your equipment in your budget, and make sure it’s up to date. Did you buy anything recently that you need to add? Do you WANT to buy something soon? Add it in.

I like to go into detail and add everything. Everything means all trucks, trailers, equipment and machines, laser levels, cutoff saws, blowers, job trailer tools, compactors, attachments, and so on. Usually, anything over $1,000 or so I like to put in as an individual item, and then I add another line item for Misc Tools and figure out an annual budget for what I want in my budget to be able to spend on small things like trowels, levels, shovels, drills, etc. If I expect to spend $3,000 on small hand tools like that a year, that’s what I’ll throw in.

One other thing to keep in mind when reviewing your equipment and updating your budget is to make sure the “purchase price” of the equipment you have in your budget is relevant, up-to-date pricing. For example, maybe you added a skid loader to your budget 3 years ago when you bought it, and you bought it for $50k. With inflation, it’s very likely that the machine is now closer to the $60-70k purchase price. Update all those purchase prices on all your equipment to be current-day pricing so you aren’t left holding the bag and not recovering the dollars you need to cover the costs of your equipment.

Inflation

This one can creep up on you if you aren’t paying attention. When plugging your costs into your budget for labor, materials, fuel, etc, make sure you are adjusting appropriately for inflation. Many businesses are spending far more on labor and materials than they were just a year or two ago. Just keep this in the back of your mind. As even if you don’t grow your business next year, or produce more work, your costs may be higher now for the same amount of work you normally produce.

Overhead Expenses

It’s so easy to gloss over this one and miss stuff. A little trick I like to do is make my list of overhead expenses in my budget match line for line the way my Profit & Loss is set up in my Quickbooks. That way I can compare easily line for line, and make sure I’m not missing anything. Things like “Oh yes, I forgot about those t-shirts we bought for the guys” “Wow, we spent a lot more on fuel than I had budgeted” and so on. Take the time to painstakingly make sure you’ve got everything in there. I like to even add a “fluff factor” above and beyond all my overhead expenses just to be safe. After I’ve got everything in there add another line for that fluff factor for another 5% or 10% of additional overhead dollars.

Owners Pay

Paying yourself? If you aren’t, you need to be. The business’s profit is not your pay as an owner. That doesn’t count. The business needs to make a profit AFTER you as the owner are paid and there’s not a single bill left to pay.

After all, you are in business to build a better life for your family, AND your team. Right? Not to be a slave to the business. But for the business to serve you, your family, and your team.

If you don’t pay yourself, it’s not just you that suffers. It’s your family too.

Mindset

If you finish building your budget and there are problems, like having a negative net profit, or you feel the markups or manhour price is too high, you’ve got two levers you can pull:

- either you can lower expenses somewhere in your budget. This usually means lowering overhead, selling equipment, etc (usually not the “growth way” to respond to this)

- or you can increase the sales goal to bring the net profit to 10% or more. I like to see a 15-20% net profit.

Once you’re happy with your budget and updated it for 2023, use that budget for all the jobs you’ll be selling in 2023. You’ve just done the work of painstakingly entering all your numbers and costs. Now it’s time to go and unapologetically charge the price for the job that your budget produces for you. It is what it is. It costs what it costs. That’s not your problem. You just pass the costs along, charge what you need to charge to cover overhead and expenses, plus earn a profit, so that you can own a business (and not a job).

If you are a SynkedUP user, aka SynkedUP Crew member, reach out to us in the chat on our site, and we’ll be happy to help you. We’re not successful unless you are successful, and you have a bulletproof budget is where that all starts.

Cheers guys! 🥂

It’s a bit after 11 PM here, I’m sitting on the back patio enjoying the beautiful fall night. But I gotta get up at 4 AM for an event tomorrow, so I’m checking out. Let me know if you want clarification on anything. Or if you have a point to add that I missed.

All my best

Weston

Weston Zimmerman

CEO and co-founder

See SynkedUP in action

Related Articles

What is the Most Difficult Challenge You’ve Overcome?

Cutting costs isn't the same as saving money. Learn how to use leverage, not panic, to drive real profit and...

Why Time Tracking is Critical for Contractors

Cutting costs isn't the same as saving money. Learn how to use leverage, not panic, to drive real profit and...

Why Cutting Costs Isn’t the Same as Saving Money

Cutting costs isn't the same as saving money. Learn how to use leverage, not panic, to drive real profit and...

Slow Down to Speed Up

A quick leadership gut check: Are you building what really matters? Slow down, realign, and lead with intention.

The One Calculation Every Contractor Should Know

Contractors: If you’re not factoring in overhead, you're not pricing right. Learn how to calculate breakeven and stop guessing your...

What Owns Your Day? Urgency or Importance?

Stuck in a cycle of chaos and urgent tasks? Break the cycle with better systems, clear processes, and leadership that...

Taking Care of Your Team

Leadership isn't barking orders - it's listening, appreciating, and building problem solvers. Here's how to lead without burning out.

The Cost of Avoiding Issues in Your Business

Avoiding stuff in business adds up, with interest. Don't try harder, build systems that make success default. Do hard things,...

Leveraging Your Job Data for More Accurate Estimates

Stop estimating from the gut. Track time, collect job data, and turn it into faster, more accurate production rates.

How the Best Contractors Ensure Profitability

Running over estimated hours is one of the biggest silent profit killers in contracting. Here's how to track it, catch...